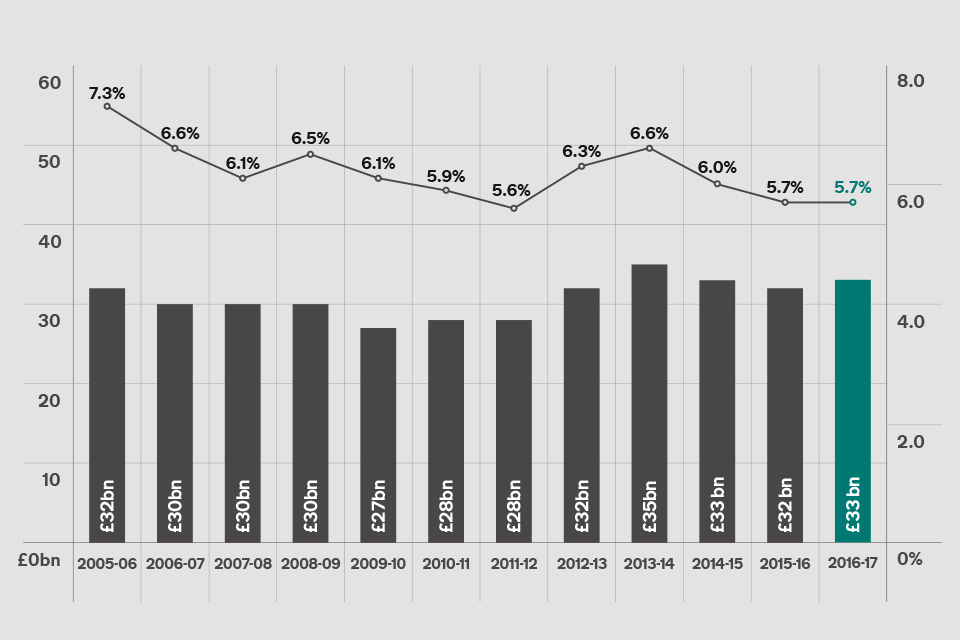

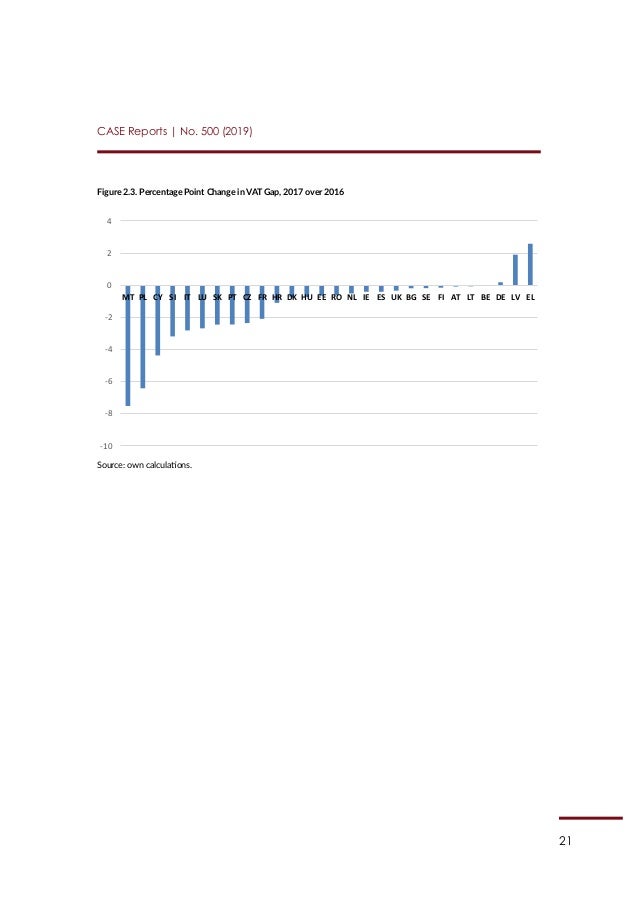

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

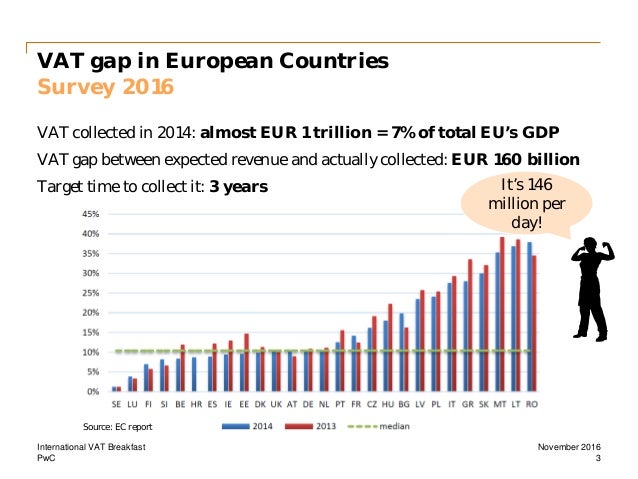

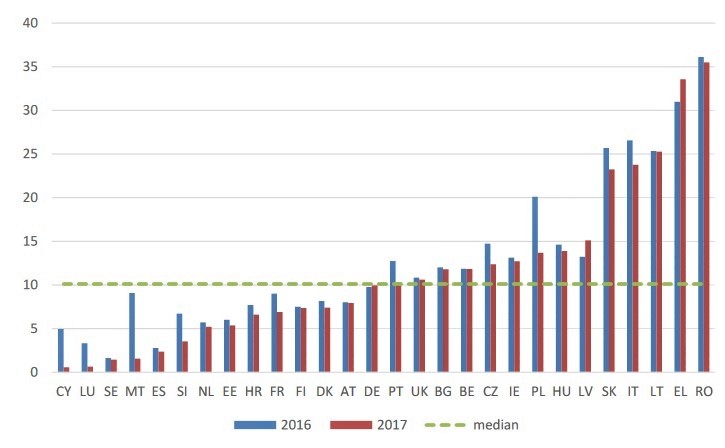

European Commission 🇪🇺 on Twitter: "What is the VAT Gap? | Main findings of the 2016 Report | Estimates per Member State → Q&A: https://t.co/IQBiB37f21… "

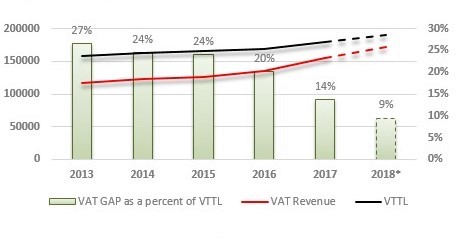

European Commission 🇪🇺 on Twitter: "EU countries lost almost €150 billion in #VAT revenues in 2016, according to our new study. They have been reducing this 'VAT Gap', but a substantial improvement

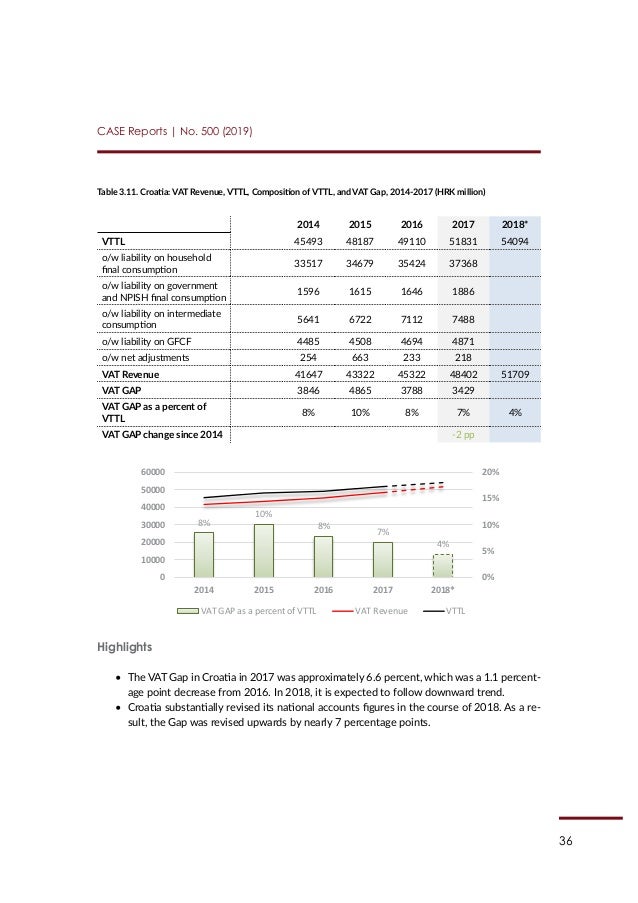

19. Netherlands: VAT Revenue, VTTL, Composition of VTTL, and VAT Gap,... | Download Scientific Diagram

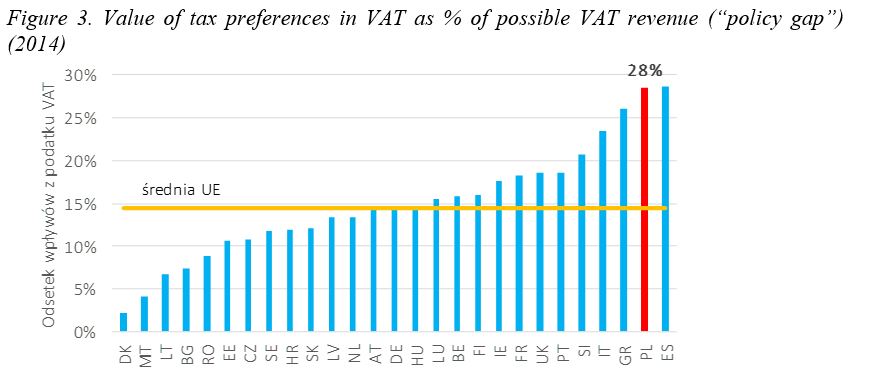

VAT gap in the EU-27 in 2014 (% VTTL). Source: TAXUD/2015/CC/131, 2016,... | Download Scientific Diagram

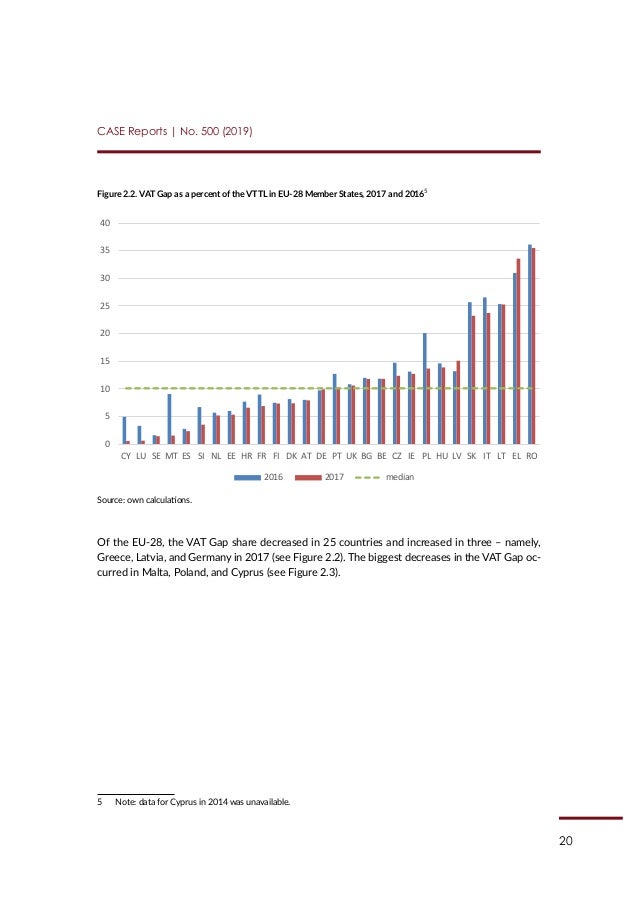

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research